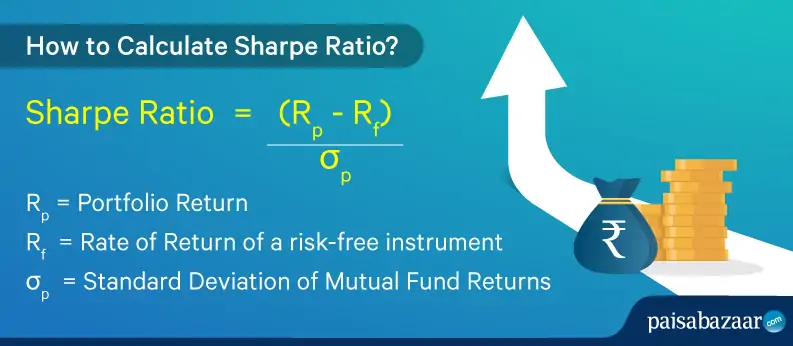

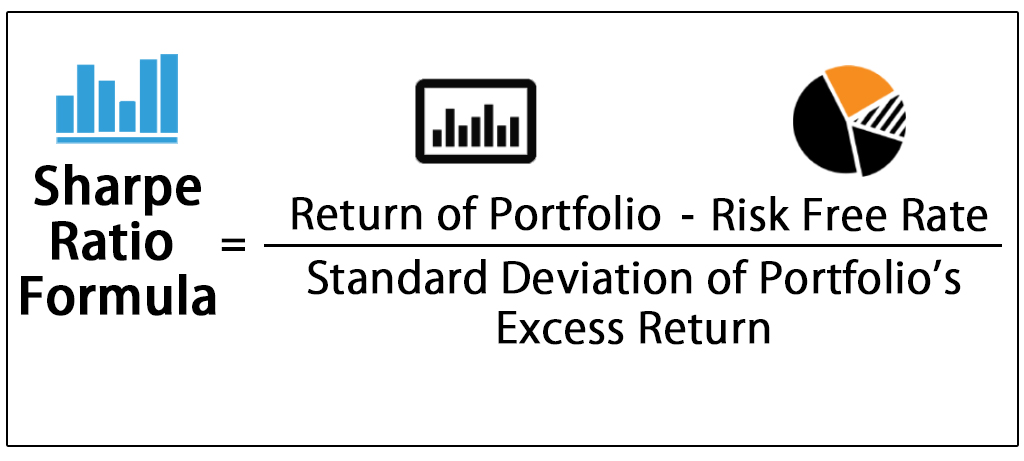

What Is A Sharpe Ratio In A Mutual Fund. The formula for sharpe ratio is shown above. Sharpe ratio indicates if a fund will get you additional returns for your investment. The Sharpe Ratio measures the risk-adjusted return of a security. If two funds offer similar returns the one.

Namaskar Dosto aaj hum bar krenge mutual funds ki ek aur risk measure ka yani Sharpe Ratio ka. Sharpe ratio helps in evaluating the additional returns after adjusting it to the risk of a fund. The Sharpe Ratio measures the risk-adjusted return of a security. Learn how to get started by watching this video. The first part of the series focused on two important mutual fund parameters rolling returns and standard deviation. Created by Nobel laureate William F.

If two funds offer similar returns the one.

The historical sharpe ratio uses historical returns to calculate. Sharpe ratio helps in evaluating the additional returns after adjusting it to the risk of a fund. From the formula we can see how it. The first part of the series focused on two important mutual fund parameters rolling returns and standard deviation. The Sharpe ratio is often used to compare the change in overall risk-return characteristics when a new asset or asset class is added to a portfolio. This is where the Sharpe ratio comes into play.