Sharpe Ratio Of The Sp 500. 500 Zeilen Perhaps the best metric for analyzing both risk and return is the Sharpe. This filters for SP 500 stocks with forward PE ratios less than or equal to 15. This is better than the Sharpe ratio of my portfolio which was only 034. Find the best performing stocks in the market based on their Sharpe Ratios.

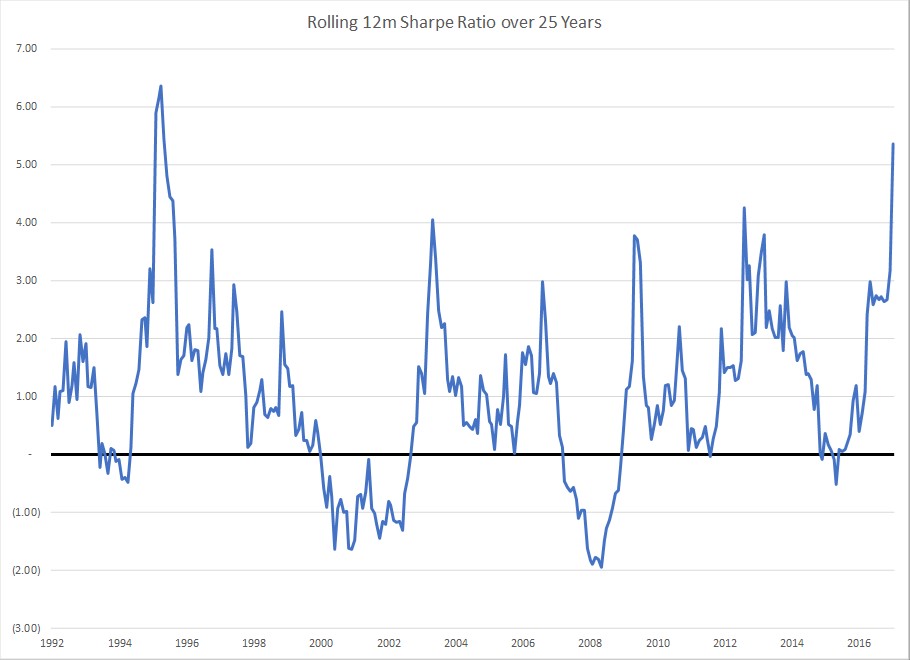

Beta and Sharpe are calculated using 3 years of bi-weekly returns. To learn more about Beta and the Sharpe Ratio check out my post about measuring risk and return. Adjusted Sharpe Ratio. Below table compares one year sharpe ratio. SP 500 performance is 10. For this simple review I used monthly SP 500 returns published by Professor Robert Shiller.

SP 500 performance is 10.

For this simple review I used monthly SP 500 returns published by Professor Robert Shiller. SP 500 performance is 10. Stocks have had the best decade since the 1950s. SP 500 SPX 406304 -8906 -214 USD May 12 2000. Most impressively however the SP 500s excess return achieved a Sharpe Ratio of almost 130. Although it looks like B performs better in terms of return when we look at the Sharpe Ratio it turns out that A has a ratio of 2 while Bs ratio is only 05.