Evidence Of Market Efficiency. Market efficiency concerns the extent to which market prices incorporate available information. Its total market capitalisation at Januarys close was 212 billion which is less than 1 of the market cap of Apple Inc for the moment the largest stock in the SP 500. We find that market efficiency is impaired after exogenous reductions of sell-side analysts suggesting that sell-side analysts contribute to price discovery. The theory states that the market is weakly efficient because it doesnt allow Jenny to earn an excess return by selecting the stock based on historical earnings data.

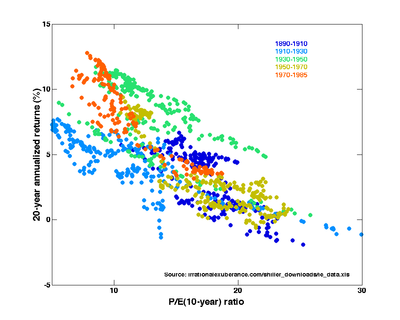

The efficiency of financial markets has long been a contentious issue and as financial markets have evolved both in their breadth and complexity the question whether financial. Therefore assuming this is true no amount of analysis can give an investor an edge over other investors collectively known as the market. The Efficient Market Hypothesis EMH essentially says that all known information about investment securities such as stocks is already factored into the prices of those securities 1. Discuss whether there is sufficient empirical support for each of these hypotheses. Some Anomalous Evidence Regarding Market Efficiency Michael C. In other words an efficient market is one in which the price of every stock or security incorporates all the available information and hence the price is the true investment value.

The Efficient Market Hypothesis EMH essentially says that all known information about investment securities such as stocks is already factored into the prices of those securities 1.

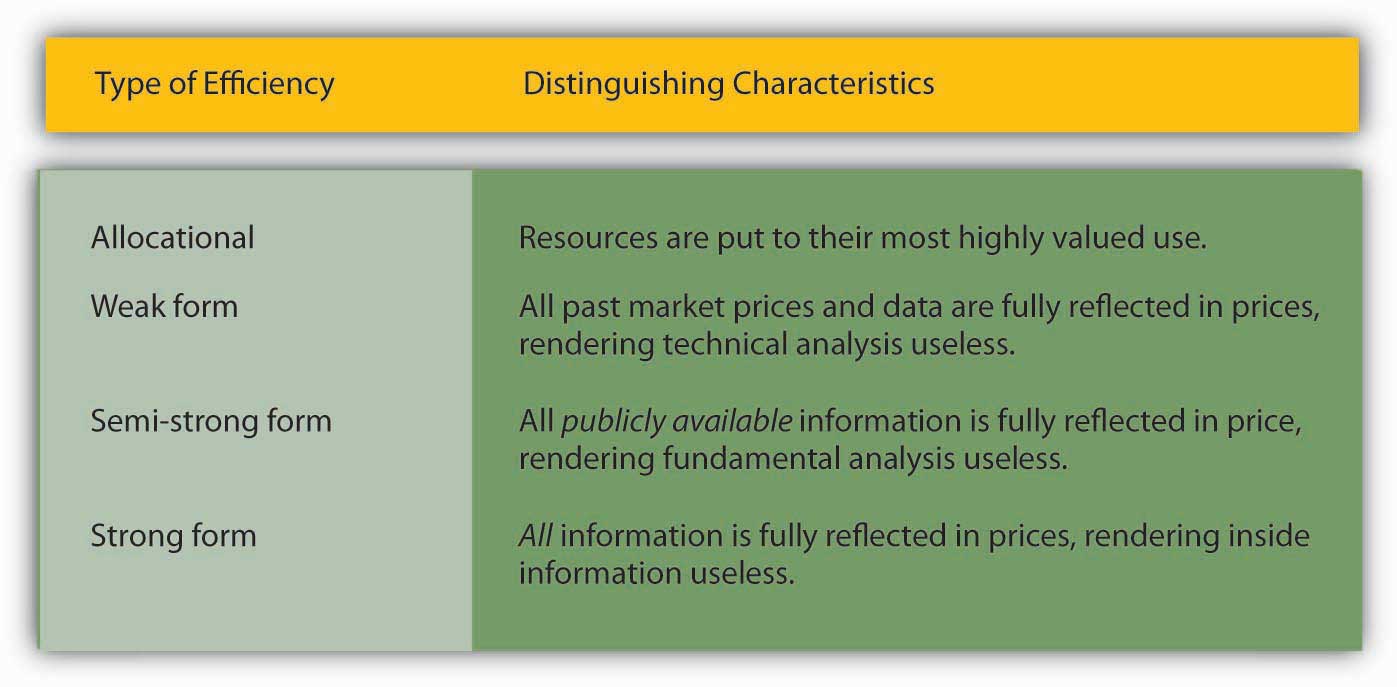

The efficiency of financial markets has long been a contentious issue and as financial markets have evolved both in their breadth and complexity the question whether financial. Unlike sophisticated investors corporate insiders have access to private information at no cost. Further empirical work has highlighted the impact transaction costs have on the concept of market efficiency with much evidence suggesting that any anomalies pertaining to market inefficiencies are the result of a cost benefit analysis made by those willing to incur the cost of acquiring the valuable information in order to trade on it. Evidence in favor of market efficiency has examined the performance of investment analysts and mutual funds whether stock prices reflect publicly available information the random-walk behavior of stock prices and the success of technical analysis. 1008922 Outline various versions of Efficient Market Hypotheses. Market efficiency concerns the extent to which market prices incorporate available information.