Drawdown Meaning In Banking. In trading a drawdown refers to a reduction in equity. Drawdowns help assess risk compare investments and are used to monitor trading. The borrower pays off the loan amount in increments usually with interest until the drawdown amount and other term agreements are satisfied. Drawdown in Banking vs.

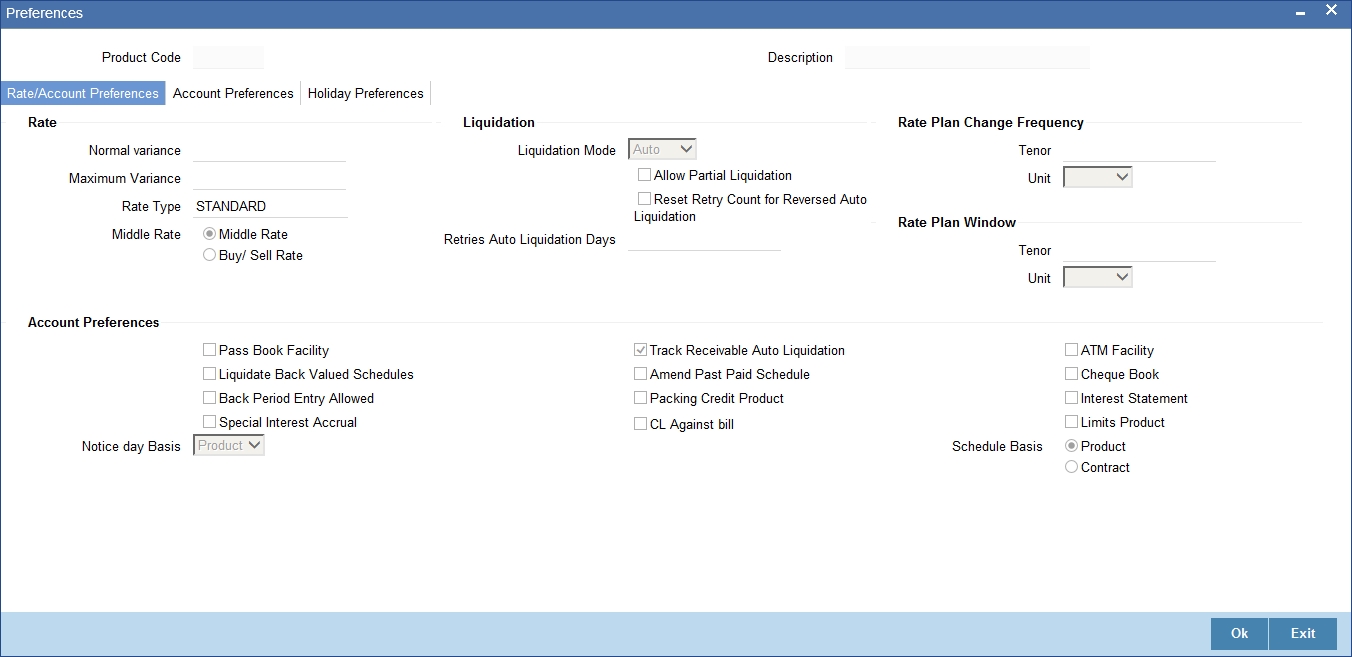

In construction a situation in which a company receives part of the funding necessary to complete a project. In finance the drawdown is a concept related to loan facilities that allow the borrower to obtain funds from a credit line during the loan period. The borrower pays off the loan amount in increments usually with interest until the drawdown amount and other term agreements are satisfied. The drawdown is when the lender processes the money and deposits it in the borrowers bank account. An Overview The term drawdown appears in both. Drawdown magnitude refers to the amount of money or equity that a trader loses during the drawdown period.

The drawdown is when the lender processes the money and deposits it in the borrowers bank account.

The borrower pays off the loan amount in increments usually with interest until the drawdown amount and other term agreements are satisfied. Providing your lender shares the credit agreement with the Credit Reference Agencies then you can expect your account to appear on your Credit Report showing the current balance account status. The key difference between drawdowns in banks is the borrowers gradual access to credit funds. Drawdowns help assess risk compare investments and are used to monitor trading. Drawdown in Banking vs. An Overview The term drawdown appears in both.