Confirmatory Value Accounting Example. 2 the number of unique variances and covariance is p p 12 4 4 12 10. Confirmatory due diligence is performed after the term sheet is issued in order to validate assumptions made by the seller. Financial due diligence is performed to review financial performance and verify accounting processes. For example revenue information for the current year which can be used as the basis for predicting revenues in future years can also be compared with revenue predictions for the current year that were made in past years.

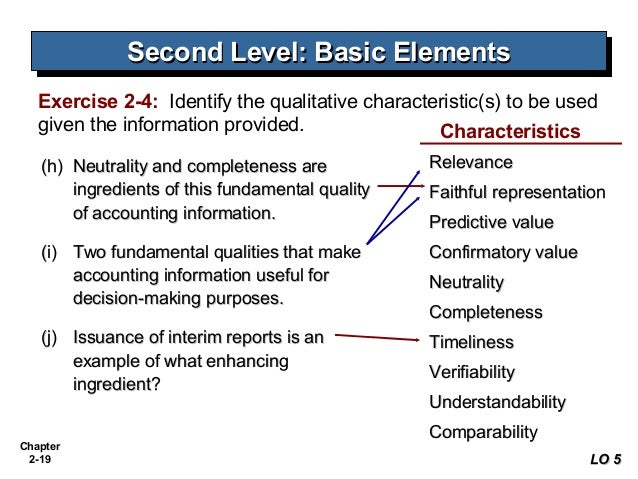

Predictive and confirmatory values determine relevance. They want to predict future dividends and that the company will be. People read accounting financial statements in order to create predictions about the future. Characteristics h Neutrality and completeness are ingredients of this fundamental quality of accounting information. The title is printed in the output just before the Summary of Analysis. What is Confirmatory Value.

In accounting information has confirmatory value when it helps users to confirm or adjust prior expectations.

It means that what is material to one entity may not be material to another. Therefore this model passes the t rule for identification because 10 to 9 1. However if the amount of default is say 2 million the information becomes relevant to the users as it may affect their view regarding the financial performance and position of the company. The number of free parameters is 9 4 factor weights 1 covariance between factors 4 error variances. The title is printed in the output just before the Summary of Analysis. This is irrelevant information because it.