China Income Tax Rates 2016. Income from the lease or transfer of property. Income between 元 4501 and 元 9000 max 元 1245 income tax 25. VAT applies to interest from 1 May 2016 Business Tax BT had. Income from interests stock dividends and bonuses.

China Business Tax or Corporate Income Tax CIT applies to all companies in China. Non-employment income is taxed at a rate generally ranging from 5 to 35 percent depending on the income source. Income from interests stock dividends and bonuses. Dividend additional rate for. The China tax tables provide additional information in relation to periodic tax returns in China. Tax On This Income 0 to 19400 Nil.

Choose a specific year to see the income tax rates and thresholds in China and its specific provinces for Social Security or select a supporting Salary Calculator to calculate your salary after tax in China.

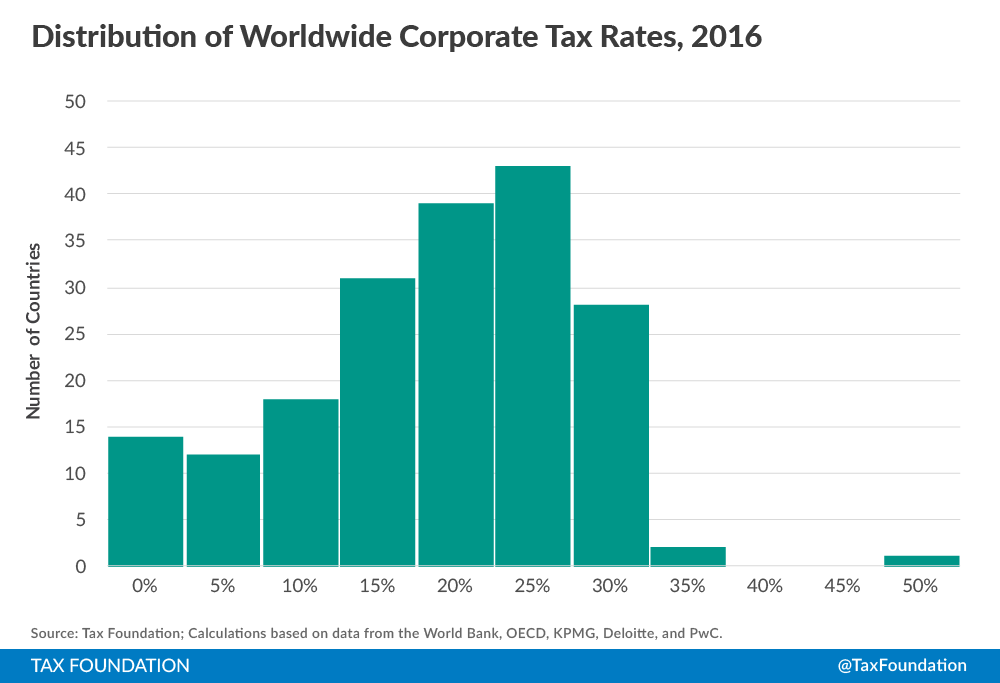

Calculation method of personal income tax for foreigners. Corporate Tax Rates in China. Calculation method of personal income tax for foreigners. IT is inTended To assisT Companies doinG business in or wiTh China To naViGaTe The. Apart from these VAT tax rates there is also an assessable tax rate of 35 for small-scale tax payers. Corporate Tax Rate 2500.