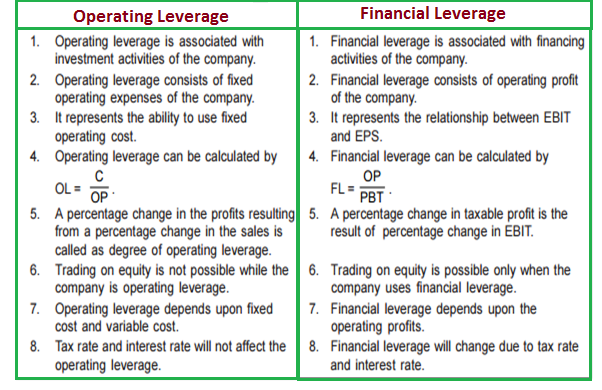

Characteristics Of Financial Leverage. Our measures of CEO personal characteristics such as CEO overconfidence based on CEO profile photo CEO age and CEO prior experience are significantly and negatively related to leverage. Leverage is employed to increase the return on equity. The explanatory variables of corporate characteristics are board size outside non-executive directors CEO duality. Following are the features of Financial Leverage.

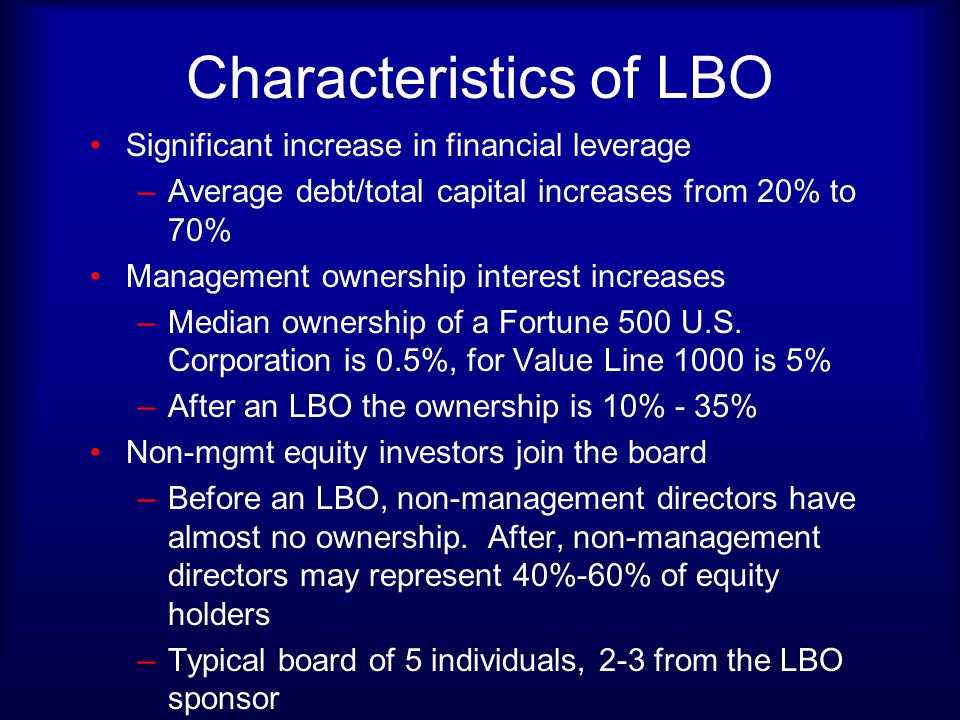

In financial management an organization is always concerned about four major issues which are sources of finance use of finance. Multiple regression methods were implied to explore the impact of corporate characteristics on leverage of the studied firms. However many empirical papers document that raw returns have a negative or at least flat relation with financial leverage and that returns adjusted by traditional sources of. Correctly identifying and with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing Interest. Total leverage is affected by firms size risk age and liquidity. Corporate financial leverage employed are the total debt ratio the long-term debt ratio and the short-term debt ratio.

Total leverage is affected by firms size risk age and liquidity.

Financial leverage is the use of debt to buy more assets. Influence of Firm Financial Characteristics on Leverage of Agricultural Listed Companies in Nairobi Securities Exchanges. It can be both good and bad for a business depending on the situation. Financial leverage refers to the utilization of borrowed funds to acquire new assets which are assumed to generate a higher capital gain or income as compared to the cost of borrowing. However CEO education level and CEO tenure are significantly and positively related to leverage. Correctly identifying and with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing Interest.