2017 Mutual Fund Flows. Refinitiv Lipper US Fund Flows Cash Track. MORN a leading provider of independent investment research today reported. US Mutual Fund and ETF Flows is at a current level of 12072B up from 6088B last month and up from 501B one year ago. Mutual fund inflows and outflows comprise.

On the active front investors pulled 179 billion out of US. Swing Pricing for Mutual Funds. Each type is uniquely affected. CHICAGO April 19 2017 PRNewswire – Morningstar Inc. In November investors placed 166 billion into US. Mutual Fund Flows and Fluctuations in Credit and Business Cycles Azi Ben-Rephael Indiana University abenrephindianaedu Jaewon Choi University of Illinois at Urbana-Champaign jaewchoiIllinoisedu Itay Goldstein Wharton School University of Pennsylvania itaygwhartonupennedu This Draft.

Mutual funds and exchange-traded funds reached a new record of just over 18 trillion.

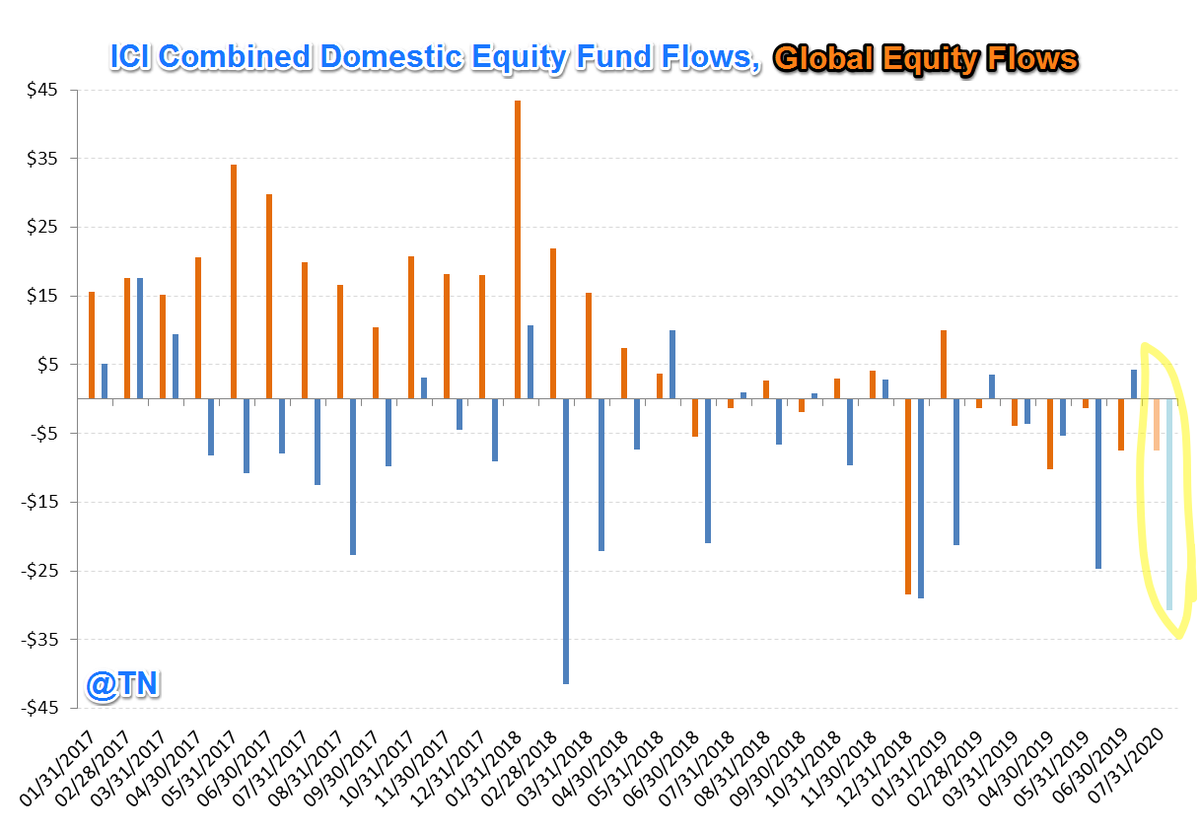

US Mutual Fund and ETF Flows is at a current level of 12072B up from 6088B last month and up from 501B one year ago. Flows are near-monotonic across the five globe categories with five-globe funds having the largest net flows and one-globe funds having the lowest flows between February 20 and April 30 2020. Refinitiv Lipper US Fund Flows Cash Track. Common factors in mutual fund flows explain significant fractions of annual and quarterly flows to individual US mutual funds. Aggregate investor flow data reveal an investor pref-erence for safe mutual funds in autumn and risky funds in spring. At the end of 2017 total assets in US.